View the TD Simple Savings Account Guide.ġFor the first 12 months, waived each month you have a linked eligible TD Bank checking account and a recurring transfer of $25 or more from a TD Bank checking account. Incoming wire transfers, money orders, stop payments, official checks, TD Bank Mobile Deposit 5

This account can be set up to protect a TD Checking account 4

This account can be set up to protect a TD Checking account 3 Other banks' ATM fees reimbursed with a minimum daily balance of $2,500. TD Bank will never charge you a fee at TD or non-TD ATMs. Tiered interest rates and relationship bump rate available 2 Link an eligible TD Checking account 1 or.Maintain a $10,000 minimum daily balance or.If you're under 24, link your savings account to a TD Convenience Checking SM account 2.If you are age 18 or younger, or 62 or older or.Complete a monthly recurring transfer of $25 or more from an eligible and linked TD Bank Checking account for the first year 1 or.Maintain a $300 minimum daily balance or.You want a savings account that rewards your higher balance with tiered interest rates and lots of account perks at no cost

TD BANK ONLINE SAVINGS ACCOUNTS PLUS

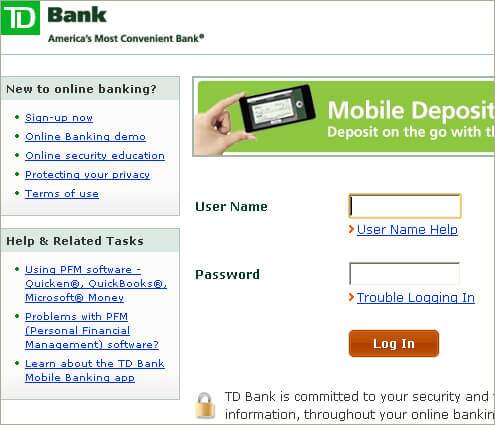

Please refer to the Mobile Deposit Addendum.You want a savings account with a low monthly fee that can be waived 1, plus other perks to help you reach your savings goals

TD BANK ONLINE SAVINGS ACCOUNTS ANDROID

The institution that owns the terminal (or the network) may assess a fee (surcharge) at the time of your transaction, including balance inquiries.ĤIf your linked account doesn’t have sufficient funds to cover your overdraft, a $35 overdraft fee may apply for each returned or paid transaction (up to 3 fees per day per account).ĥTD Bank Mobile Deposit is available to Customers with an active checking, savings or money market account and using a supported, internet-enabled iOS or Android device with a camera. View the TD Signature Savings Account Guide.ġEligible accounts include: TD Bank Personal Mortgage, Home Equity or Credit Card OR an active Personal or Small Business Checking account WITH at least three Customer-initiated deposit, withdrawal, transfer or payment transactions posted each calendar month OR an Active Personal or Small Business Checking account WITH a direct deposit each calendar month.ĢEligible accounts include: TD Beyond Checking and Relationship Checking.ģNon-TD ATMs: For Beyond Checking and TD Signature Savings accounts, TD fees waived regardless of balance, and non-TD fees, which includes any surcharges at the time of your transaction, will be reimbursed when the minimum daily balance in the TD Beyond Checking account OR TD Signature Savings account is at least $2,500. Please refer to the Mobile Deposit Addendum. Upon the account holder's 24 th birthday the account will be subject to the monthly maintenance fee unless the $100 minimum daily balance is maintained for Convenience Checking and the $300 minimum daily balance is maintained for Simple Savings.ģIf your linked account doesn’t have sufficient funds to cover your overdraft, a $35 overdraft fee may apply for each returned or paid transaction (up to 3 fees per day per account).ĤTD Bank Mobile Deposit is available to Customers with an active checking, savings or money market account and using a supported, internet-enabled iOS or Android device with a camera. See the Personal Deposit Account Agreement for more details.ĢMonthly Maintenance Fee is waived for primary account holders ages 17 through 23. Aggregate balances over $25 million are subject to negotiated interest rates. *Annual Percentage Yield (APY) is accurate as of and subject to change after the account is opened.

0 kommentar(er)

0 kommentar(er)